- #1099 EXPENSE INDEPENDENT CONTRACTOR EXPENSES SPREADSHEET UPDATE#

- #1099 EXPENSE INDEPENDENT CONTRACTOR EXPENSES SPREADSHEET PROFESSIONAL#

- #1099 EXPENSE INDEPENDENT CONTRACTOR EXPENSES SPREADSHEET DOWNLOAD#

Actually, you should read through it anyway. I’d recommend reading through the instructions for Schedule C (particularly page 4) for more information.

#1099 EXPENSE INDEPENDENT CONTRACTOR EXPENSES SPREADSHEET PROFESSIONAL#

Although there are some types of income that would be considered “other income” on Schedule C, you’re likely going to need help from a professional if that’s an issue for you.

#1099 EXPENSE INDEPENDENT CONTRACTOR EXPENSES SPREADSHEET UPDATE#

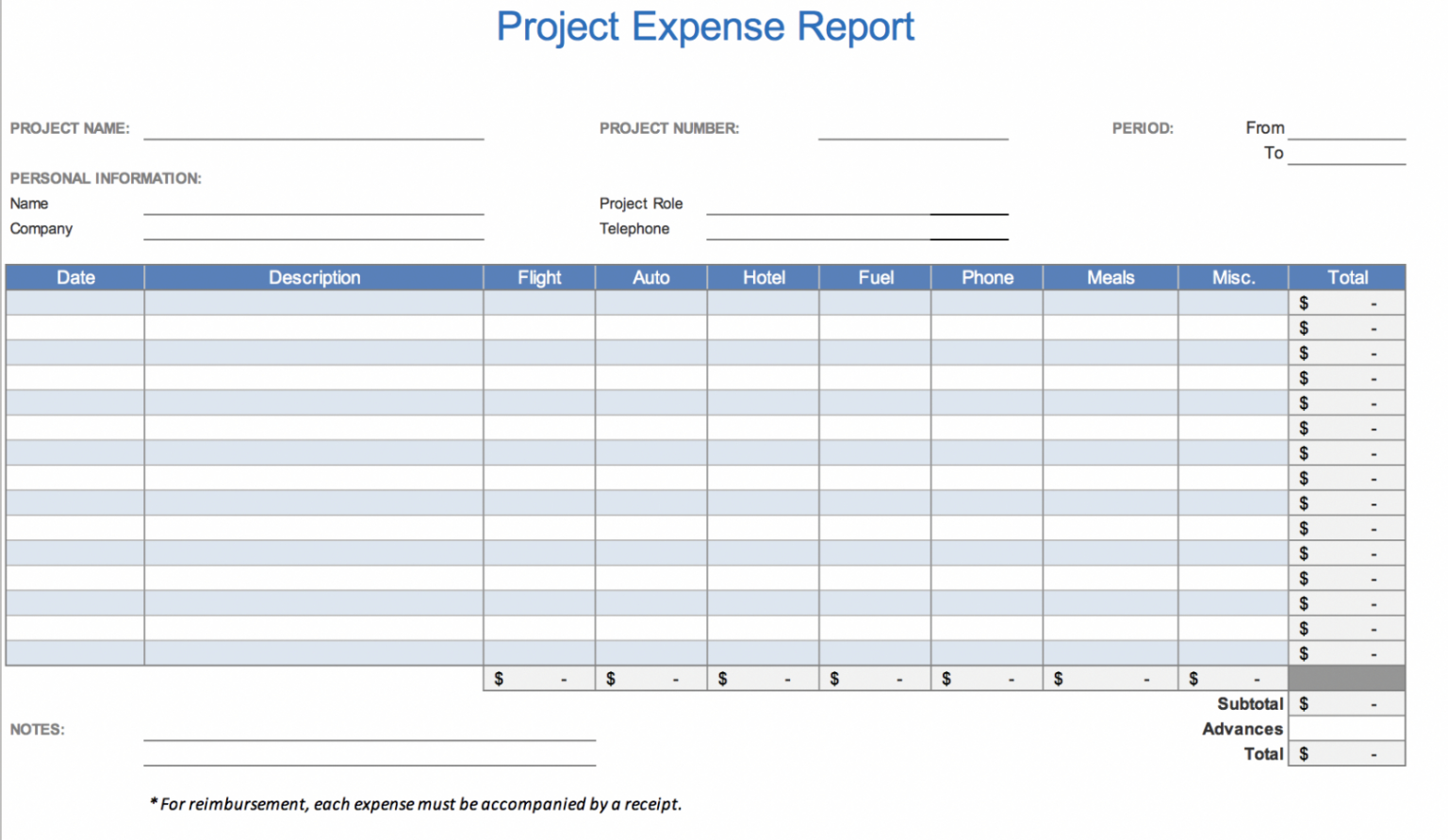

The final column will update automatically. Finally, enter the total in column E if it’s income or column F if it’s an expense.

In column D, enter a more detailed description of the item so you will be able to match it up to a bank statement or receipt if necessary. You can use the other categories as an example for how broad/narrow to make your subcategories. Try to use the same subcategories for similar items as much as possible and don’t make them too specific (just enough to make it clear what it is) – it will make tax time easier. You’ll then want to type in a subcategory for that item in column C. If you choose “Other Expenses”, then column C will change from black to white. Choose a category for each item in column B (according to the definitions below). If you buy several different things at a store, group them by category rather than lumping them together. To track your income and expenses, list each item/transaction separately on the “Income and Expenses” tab. The reason you need to do it this way is so the conditional formatting will be copied over. Be sure ‘All’ is selected, then click ‘OK’. From the ‘Edit’ menu select ‘Paste Special’. Then highlight the rows you’d like to copy it to. If you want to add more on the “Income and Expenses” tab, simply highlight the entire last empty row and hit Ctrl+c. There are 365 rows in each of the tabs you’ll be using. “Income and Expenses” is for tracking…income and expenses. The other two tabs are pretty straightforward.

I used it simply for formatting the drop down list on the “Income and Expenses” tab. (Try right clicking and selecting “Save as…” if it tries to open inside your browser.)

#1099 EXPENSE INDEPENDENT CONTRACTOR EXPENSES SPREADSHEET DOWNLOAD#

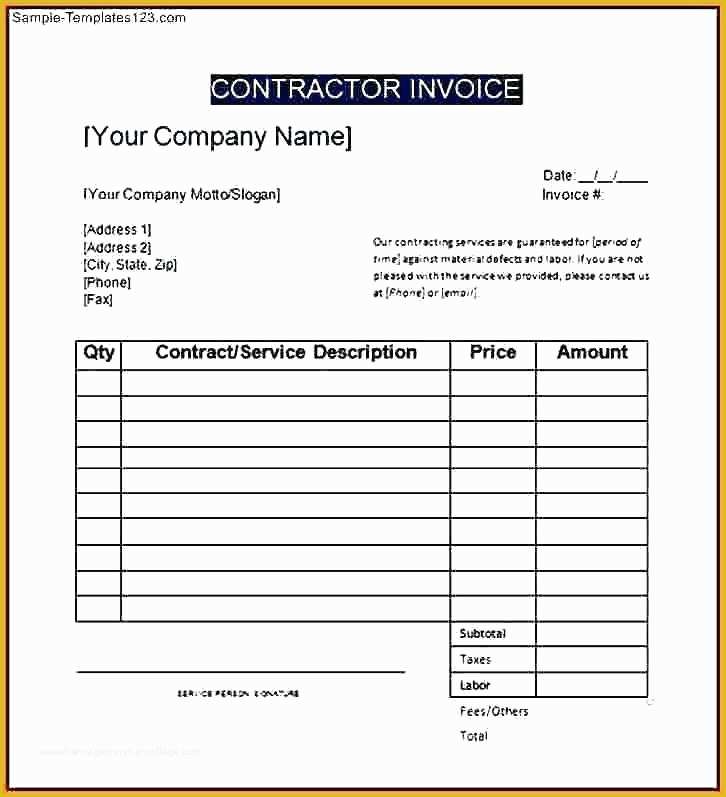

You can download my free spreadsheet for tracking your business expenses by clicking here or on the picture below. I thought about uploading it to ZohoSheets, but I’m not sure if the conditional formatting will work on there. To use the spreadsheet, you’ll need to have Microsoft Excel, Microsoft Office, or Open Office (which is free!). If you want to learn more about recordkeeping requirements, I’d recommend reading IRS Publication 583 and Publication 463.įree Spreadsheet for Tracking Your Business Expenses I made all of this general enough so I can use it with other clients, and I thought some of you might find it useful for your own businesses.īefore I get into explaining the spreadsheet, let me just add that you’ll still need to have records like receipts and bank statements to back up the expenses you claim. I also put together a guide to help her know which categories to choose for each item so it’ll correspond to the tax return. I put together an Excel spreadsheet with columns for all the information you need to track business expenses for Schedule C. Recently, I had a client ask me for a spreadsheet to help her track her business expenses.

0 kommentar(er)

0 kommentar(er)